Q4 & FY21 Results of Avenue Supermarts

Mumbai, May 8, 2021: Avenue Supermarts Ltd. (ASL), one of the largest food & grocery retailers in India, today declared its standalone and consolidated financial results for the quarter and year ended March 31, 2021.

Standalone results

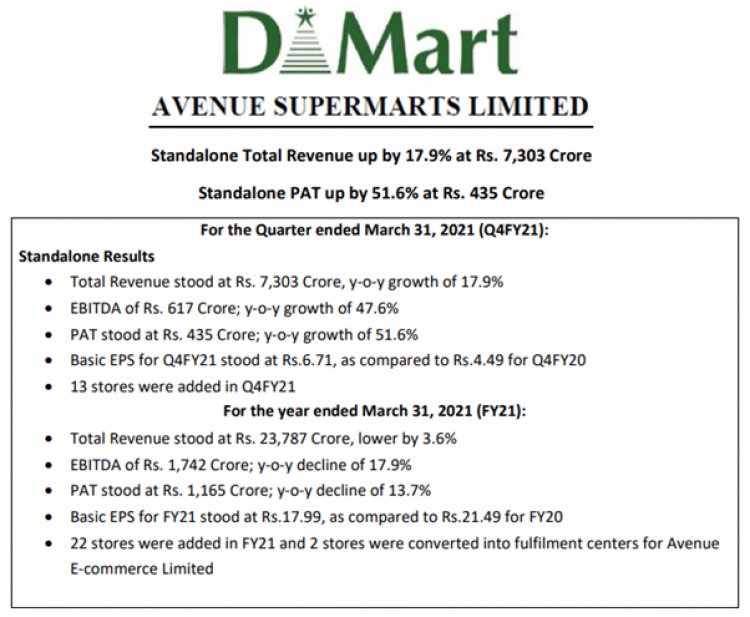

Total Revenue for the quarter ended March 31, 2021 stood at Rs. 7,303 crore, as compared to Rs. 6,194 crore in the same period last year. Earnings before Interest, Tax, Depreciation and Amortization (EBITDA) in Q4FY21 stood at Rs. 617 crore, as compared to Rs. 418 crore in the corresponding quarter of last year. EBITDA margin stood at 8.4% in Q4FY21 as compared to 6.7% in Q4FY20.

Net Profit stood at Rs. 435 crore for Q4FY21, as compared to Rs. 287 crore in the corresponding quarter of last year. PAT margin stood at 5.9% in Q4FY21 as compared to 4.6% in Q4FY20.

Basic Earnings per share (EPS) for Q4FY21 stood at Rs.6.71, as compared to Rs.4.49 for Q4FY20.

Total Revenue for FY21 stood at Rs. 23,787 crore, as compared to Rs. 24,675 crore in the same period last year. Earnings before Interest, Tax, Depreciation and Amortization (EBITDA) in FY21 stood at Rs. 1,742 crore, as compared to Rs. 2,122 crore during FY20. EBITDA margin stood at 7.3% in FY21 as compared to 8.6% in FY20.

Net Profit stood at Rs. 1,165 crore for FY21, as compared to Rs. 1,350 crore in FY20. PAT margin stood at 4.9% in FY21 as compared to 5.5% in FY20.

Basic Earnings per share (EPS) for FY21 stood at Rs.17.99, as compared to Rs. 21.49 for FY20.

Consolidated results

Total Revenue for the quarter ended March 31, 2021 stood at Rs. 7,412 crore, as compared to Rs. 6,256 crore in the same period last year. Earnings before Interest, Tax, Depreciation and Amortization (EBITDA) in Q4FY21 stood at Rs. 613 crore, as compared to Rs. 417 crore in the corresponding quarter of last year. EBITDA margin stood at 8.3% in Q4FY21 as compared to 6.7% in Q4FY20.

Net Profit stood at Rs. 414 crore for Q4FY21, as compared to Rs. 271 crore in the corresponding quarter of last year. PAT margin stood at 5.5% in Q4FY21 as compared to 4.3% in Q4FY20.

Basic Earnings per share (EPS) for Q4FY21 stood at Rs. 6.39, as compared to Rs. 4.25 for Q4FY20.

Total Revenue for FY21 stood at Rs. 24,143 crore, as compared to Rs. 24,870 crore in the same period last year. Earnings before Interest, Tax, Depreciation and Amortization (EBITDA) in FY21 stood at Rs. 1,743 crore, as compared to Rs. 2,128 crore during FY20. EBITDA margin stood at 7.2% in FY21 as compared to 8.6% in FY20.

Net Profit stood at Rs. 1,099 crore for FY21, as compared to Rs. 1,301 crore in FY20. PAT margin stood at 4.5% in FY21 as compared to 5.2% in FY20.

Basic Earnings per share (EPS) for FY21 stood at Rs. 16.97 as compared to Rs. 20.71 for FY20.

D-Mart follows Everyday low cost - Everyday low price (EDLC-EDLP) strategy which aims at procuring goods at competitive price, using operational and distribution efficiency and thereby delivering value for money to customers by selling at competitive prices.

Commenting on the performance of the company Mr. Neville Noronha, CEO & Managing Director, Avenue Supermarts Limited, said:

FY 2021 has been a challenging year for our business. The year began amidst a strict lockdown post the emergence of the Coronavirus (Covid-19) towards the end of the last financial year. The economy gradually opened post May 2020 and the second half of the year was progressing towards recovery. However, a much stronger second wave of Covid-19 infections hit the country towards the end of FY 2021 and has once again resulted in significant disruption to our business as several cities and towns have announced restrictions.

DMart (Brick and Mortar) Business Overview

During FY 2021, we have seen a degrowth across our key financial parameters of Revenue, EBITDA and PAT. Our sales mix has also seen a shift towards Grocery and FMCG products. Sales from General Merchandise and Apparel formed 22.90% of our total revenue for the year as compared to 27.31% in the previous year. This is a result of consumer preference of need based / essential goods shopping for a significant period during the year, reduced discretionary spending and significant restrictions on selling non-essentials during the early part of the year. This has also impacted our margins during the year. However, Q4 margins did indicate revival of discretionary spends not seen in previous 3 quarters.

We adopted all safety protocols as mandated and recommended by the authorities to safeguard the health and well-being of our customers and employees. We continue to follow these at all our premises.

Our construction activity was impacted during the first half of the year. We gradually commenced our store construction activity from the second half of the year and opened 22 new stores during the year.

DMart Ready

We continued the expansion of our E-Commerce business and increased our presence across the MMR region. In addition, we commenced servicing 4 new cities during the last year - Ahmedabad, Pune, Bangalore and Hyderabad.

Impact of Second Wave of Covid-19

Q4 FY 2021 began with cautious optimism as coronavirus infections had reduced and significant restrictions had been lifted across the economy. The commencement of vaccination for the population was also building strong optimism for the future. However, beginning of March 2021 the number of infections significantly increased across India. Since then local restrictions have progressively increased in April and May.

Our People: We continue to ensure stringent health and hygiene protocols at all our premises to ensure safety of our employees and customers. All employees are adequately supported during health issues or medical emergencies that they encounter, including leave from work, medical counselling and due assistance to avail appropriate healthcare facilities. We also continue to encourage all employees to get vaccinated, whenever they become eligible as per criteria notified from time to time.

Store Operations: Significant disruptions have been seen from March 2021 onwards for our store operations. The restrictions and local level enforcements have become much stricter. Restrictions vary from store closures on certain days or for extended periods, to restricted store operating hours and selling only essential goods in most cities and towns. In general, more than 80% of our stores are operating for significantly lower number of hours (not exceeding four hours per day) or are even shut for operations for one to weeks or shut on weekends. These shut downs are having an adverse and severe impact on our revenues.

Supply Chain: We currently continue to receive regular supply of goods from our suppliers. However, this time we may have a problem of excess inventory. An issue larger than the first wave. The receding threat of the pandemic and consequent sales surge in Q3 and most of Q4, followed by the oncoming summer and backto school season made us plan more optimistically. This could have a longer-term impact on our inventory to sales ratio as we could take comparatively longer time to liquidate the excess inventory.

Construction Activity: Since March 2021 we are once again witnessing significant restrictions for construction activity across towns and cities. As of now, we would be unable to forecast the impact of the current lockdowns on our store opening pipeline for this year. However, we remain optimistic here as migration of construction workers is not visible like the first time. It is quite evident that confidence is far better this time due to vaccination drives, appropriate medical knowledge to deal with the pandemic and probably better herd immunity amongst the blue collared workers.

Conclusion

A key difference between last year and this year is that the healthcare fraternity and government authorities have better knowledge to tackle the pandemic. Additionally, we now have the benefit of multiple vaccines being available for all adults in the country. However, we expect more frequent lockdowns across cities and towns. This trend is likely to continue until a large part of the population is vaccinated and new infections reduce significantly and remain like that for a long period of time.

About Avenue Super marts Limited: (www.dmartindia.com; BSE: 540376; NSE: DMART)

Avenue Supermarts Limited is a Mumbai-based company, which owns and operates D-Mart stores. D-Mart is a national supermarket chain that offers customers a range of home and personal products under one roof. The Company offers a wide range of products with a focus on Foods, Non-Foods (FMCG) and General Merchandise & Apparel product categories. The Company offers its products under various categories, such as grocery and staples, dairy and frozen, fruits and vegetables, home and personal care, bed and bath, crockery, footwear, toys and games, kids’ apparel, apparel for men & women and daily essentials.

The Company opened its first store in Mumbai, Maharashtra in 2002. As of March 31, 2021, the Company had 234 operating stores with Retail Business Area of 8.82 million sq. ft. (adjusted for space leased to AEL during the year) across Maharashtra, Gujarat, Daman, Andhra Pradesh, Karnataka, Telangana, Tamil Nadu, Madhya Pradesh, Rajasthan, NCR, Chhattisgarh and Punjab.